NPH advisors left with little time to make fraught LPL decision

September 19, 2017

By Tobias Salinger, Financial Planning

More than 1,600 advisors with National Planning Holdings broker-dealers face a wrenching decision: Join LPL Financial or take their practices elsewhere, with little time to make the choice.

LPL plans to take over all National Planning and Investment Centers of America accounts Dec. 2, less than 120 days after LPL acquired NPH. Even before then, advisors of the two firms must make their intentions clear or risk consequences, according to a mass NPH email obtained by Financial Planning.

Brokers who want to join a new BD must do so by Nov. 3, at which point the memo says NPH will terminate their registration. If they don’t move out their accounts by Oct. 5 — 29 days earlier — their clients will receive so-called negative consent letters notifying them of the looming transfer to LPL.

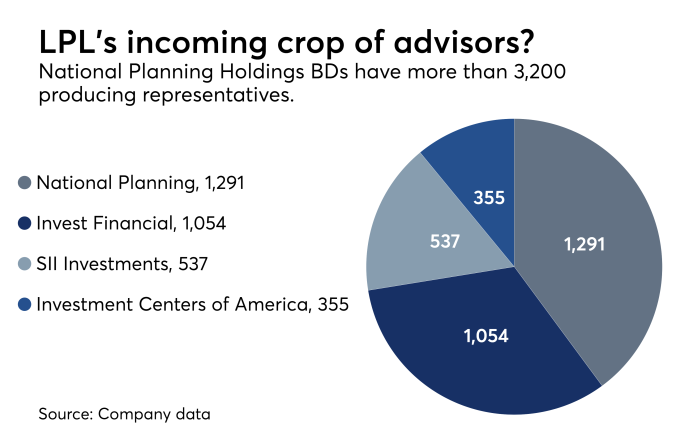

LPL has begun its outreach to the roughly 3,200 NPH advisors, offering sweeteners like retention pay and reimbursement of all conversion fees. Assets from SII Investments and Invest Financial, NPH’s two other BDs, won’t move until February. The first half of the onboarding imposes a tight deadlines, though.

In contrast, MassMutual took more than a year to complete its acquisition of MetLife’s Premier Client Group after the first announcement of the deal.

Advisors with the former Deutsche Bank Wealth Management’s U.S. Private Client Services Unit became Alex. Brown advisors last September some 10 months after Raymond James unveiled the purchase. And Stifel’s 2015 acquisition of Barclays’ U.S. wealth management division took six months.

Experts point out that LPL and former NPH parent Jackson National Life Insurance have millions of dollars at stake on top of the initial $325 million paid by LPL. The firm’s competitors are aiming their recruiting efforts at NPH’s BDs. The memo lays out why LPL would make for the easier near-term pick.

“We understand that LPL either has reached out to you (or soon will) to discuss your opportunities and to provide you with additional details concerning affiliation with its firm,” says the memo.

“In order to facilitate the transition for you and your clients, we encourage you to meet with LPL to discuss how you will benefit from the scale, strength and stability of a firm that understands the needs of advisors like you and will create better economics for you and your clients.”

‘NOT LIKE TURNING ON A SWITCH’

Advisors who leave NPH but don’t resign by the deadline will receive a termination filing on their permanent Form U5, according to the memo. Clients will receive the negative consent mailing whether their advisors intend to leave or not, and advisors need clients’ approval to move their assets elsewhere.

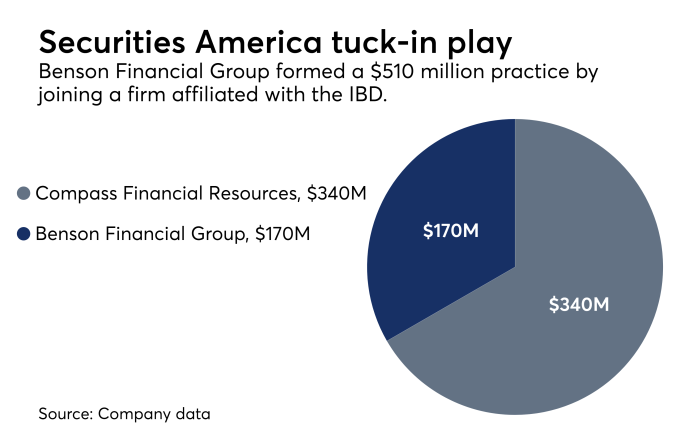

Some see the situation as fruitful for advisors in soliciting competing bids from firms. Recruiters have quickly pounced on the fast timeline, noting that Securities America has grabbed two practices from National Planning in the past month. The timing leaves little time for due diligence, though.

“You need several weeks to a month to get ready, to transition. It’s not like turning on a switch,” says recruiter Mark Elzweig, noting the Nov. 3 cutoff date for two of the four NPH firms. “That doesn’t sound very realistic. It sounds almost like they’re strong-arming them to stay.”

A spokeswoman for National Planning Holdings declined to comment on the memos, while a spokesman for LPL referred to comments by Bill Morrissey, the firm’s managing director for business development. Morrissey notes that “no one likes change,” but he says LPL will “eliminate or minimize disruption.”

“I don’t want to be presumptuous. All these advisors need to make a choice, and we want to help them make the right choice,” Morrissey told FP last week after meeting with NPH advisors. LPL has agreed to pay Jackson National up to $123 million in contingency pay based on the level of retention.

WINNERS AND LOSERS

The four NPH firms, which disclosed $909.4 million in combined revenue last year, could push the headcount of the nation’s largest IBD past those of all wirehouse firms. National Planning constitutes the 15th largest IBD, followed by Invest Financial (No. 26), SII (31) and Investment Centers (42).

On the other hand, Securities America makes up the ninth largest IBD. Advisors with the new practices, one of which combined with the other into an office of supervisory jurisdiction, made their decisions prior to the deal, they said. Both advisors expressed doubts about LPL as a possible fit for them, however.

The firm’s potential size after the deal makes it a turn-off for NPH advisors, according to recruiter Jon Henschen, who arranged the Securities America poaches. LPL’s technology will make the transition easier for advisors, but the firm is “speeding it up because reps are starting to leave,” Henschen says.

“The loser is Jackson because they’re only getting a portion of the money up front,” he says. “If they let things drag on a bit until the beginning of the year, I think they’ll find that has a negative impact on retention.”

Henschen adds that he’s watching closely to see if Jackson threatens to cut advisors’ trailing pay on annuity contracts, a step he says MetLife took to penalize advisors who left before the transition to MassMutual earlier this year. A MassMutual spokesman referred questions to MetLife, where a spokeswoman did not immediately respond to requests for comment.

“MetLife communicated compensation changes to third-party firms in the same time-frame at the end of June 2017. While MetLife is unable to discuss the compensation paid to a firm under a specific agreement, it is the company’s goal to maintain consistency in its approach to compensation it pays to third-party firms,” spokeswoman Judi Mahaney said in a statement.

Acquisitions always touch off maneuvering between firms and advisors, according to consultant Tim Welsh of Nexus Strategy. Savvy advisors will extract the best possible terms for themselves and their clients from LPL through the process, he says.

“That’s the game that has been played forever,” Welsh says, noting LPL also faces a difficult task in coming months. “From a business point of view, you absolutely have to move fast and lock advisors down.”