2011 Broker-Dealer Presidents’ Poll

by John Sullivan and featured in Investment Advisor & AdvisorOne

June, 2011:

We asked BD recruiting expert Jon Henschen for his take on the responses. What he had to say will surprise you.

Investment Advisor surveyed over 70 presidents and heads of broker-dealers big and small. We asked about the regulatory environment, compliance, recruiting, and the long- and short-term challenges they face. Not content with the answers as they were, we asked broker-dealer recruiting expert Jon Henschen, president of Henschen & Associates, an advisor placement firm, for his “color commentary” on what the responses mean for the larger industry as a whole, and what advisors should be looking for from the broker-dealers with which they choose to partner. True to form, Henschen, a well-known writer and speaker known for his sometimes brutal honesty, didn’t hold back on his frank analysis of the state of the industry, what it means for reps and—more importantly—what it means for clients.

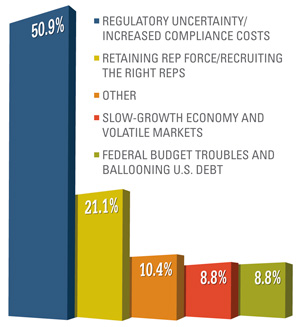

1. What issue do you feel is the most challenging to your firm business-wise in the short term (next 18 months)?

With its numerous dictates over the last several years, FINRA has become as popular as ObamaCare, with the efficiency of the postal service and the compassion of the IRS. This has been evident on the broker-dealer level, and I also noticed it at the TD Ameritrade conference—FINRA potentially regulating RIAs brought a feeling of doom to those attending. Current regulatory unknowns that have the attention of compliance departments as well as advisors are: 1) what will happen with 12b-1 fees, 2) how RIAs will be regulated, and 3) how new suitability/know-your-customer rules will shake out.

With its numerous dictates over the last several years, FINRA has become as popular as ObamaCare, with the efficiency of the postal service and the compassion of the IRS. This has been evident on the broker-dealer level, and I also noticed it at the TD Ameritrade conference—FINRA potentially regulating RIAs brought a feeling of doom to those attending. Current regulatory unknowns that have the attention of compliance departments as well as advisors are: 1) what will happen with 12b-1 fees, 2) how RIAs will be regulated, and 3) how new suitability/know-your-customer rules will shake out.

Regulatory uncertainty is a short-term issue. The longer term issue is that attracting advisors and keeping them happy will become increasingly difficult as the competition for high-quality reps shifts into high gear. Not only do firms have to seek out reps with little to no compliance baggage, they need to weed out credit problems, job hopping histories and potentially problematic alternative investment legacies on their books.

Firms are fearful of bringing on reps with multiple marks on their records because of the potential of getting on the regulator’s radar screen. There have always been issues with reps that had a bankruptcy. Now, a credit score under 600 can make a rep toxic in the marketplace.

A newer development in the marketplace is alternative investment aversion. To reps with substantial production, clean compliance and credit histories, and exposure to a minimal amount of conservative alternative investments, the world is your oyster and a world of broker-dealers awaits.

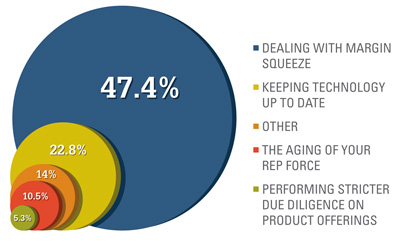

2. What issues do you feel are the most challenging to your firm business-wise in the long term (next three to five years and beyond)?

Margin squeeze gets the lion’s share percentage on the survey as the most challenging issue and that is spot on. Firms can get between a rock and a hard place on this issue as they realize reps don’t want to get under a 90% payout so they are left with raising fees to cover expenses. The current hot topic on expenses is whether to charge the huge increases in SIPC and FINRA assessment fees to the rep or absorb them, with more firms than not passing the assessment fees onto the rep. Improved markets with higher rep production have brought much needed relief to margins. Traditionally, money market accounts have been a few percentage points of broker-dealer profits. However, that evaporated when money market rates plunged, so any uptick in rates would bring a welcomed increase to profit margins. A common misconception we are hearing touted is that “economies of scale are everything.” Much of our industry’s problems over the last year had more to do with risk management than broker-dealer size, as Securities America reps will testify.

Margin squeeze gets the lion’s share percentage on the survey as the most challenging issue and that is spot on. Firms can get between a rock and a hard place on this issue as they realize reps don’t want to get under a 90% payout so they are left with raising fees to cover expenses. The current hot topic on expenses is whether to charge the huge increases in SIPC and FINRA assessment fees to the rep or absorb them, with more firms than not passing the assessment fees onto the rep. Improved markets with higher rep production have brought much needed relief to margins. Traditionally, money market accounts have been a few percentage points of broker-dealer profits. However, that evaporated when money market rates plunged, so any uptick in rates would bring a welcomed increase to profit margins. A common misconception we are hearing touted is that “economies of scale are everything.” Much of our industry’s problems over the last year had more to do with risk management than broker-dealer size, as Securities America reps will testify.

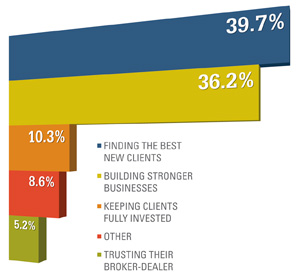

3. What issues do you feel ar the most challenging to individual reps in the short term (next 18 months)?

Here again the survey is right on the money, with building stronger businesses and finding new clients sitting at the top of the challenging issues list. On a broker-dealer level, this equates to practice management and marketing programs. Numerous broker-dealers are starting to implement practice management programs through third-party sources. However, surprisingly few firms have done much to help reps get new clients outside of commonplace platforms such as Peter Montoya’s. Besides First Allied with their Greenbook Marketing Program for gathering doctors as clients, large producer groups are another marketing source where reps can get a steady flow of new client assets through full turnkey marketing programs. Some of these producer group programs are networked in with as many as 60 corporations around the country offering clients in industries that are in layoff cycles, giving advisors substantial 401(k) rollover opportunities.

Here again the survey is right on the money, with building stronger businesses and finding new clients sitting at the top of the challenging issues list. On a broker-dealer level, this equates to practice management and marketing programs. Numerous broker-dealers are starting to implement practice management programs through third-party sources. However, surprisingly few firms have done much to help reps get new clients outside of commonplace platforms such as Peter Montoya’s. Besides First Allied with their Greenbook Marketing Program for gathering doctors as clients, large producer groups are another marketing source where reps can get a steady flow of new client assets through full turnkey marketing programs. Some of these producer group programs are networked in with as many as 60 corporations around the country offering clients in industries that are in layoff cycles, giving advisors substantial 401(k) rollover opportunities.

Going forward, broker-dealers should seriously consider several best-of-breed, third-party marketing programs with proven track records that they can offer to the reps at a discount. With marketing incentives, as with practice management, everyone wins. When you outsource programs, you keep staffing in check.

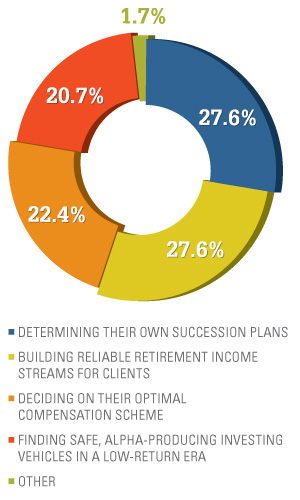

4. What issues do you feel are the most challenging to individual reps over the long term (next three to five years, and beyond)?

4. What issues do you feel are the most challenging to individual reps over the long term (next three to five years, and beyond)?

Succession plans are going to be the standout going forward because of our aging rep force. The difficulty with succession plans is that many variables need to come together, e.g., geography, matching investment style between the buyer and seller, agreement on buy-out terms, potential need for change of broker-dealer, and personality. Third-party firms such as FP Transitions make it their job to tackle the complexities of buying or selling books of business with many of the broker-dealers networked with their services.

Difficulty in building reliable retirement income streams for clients has been a factor of the low interest rate environment and will become more reliable as fixed income rates go up.

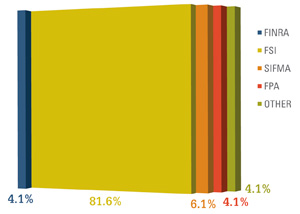

5. Which industry addociation or entity do you feel is most essential to advancing your point of view, especially in Washington, D.C.?

For years we’ve heard reps speak out with, “Who stands up for us and makes our voices heard?” FSI has been the only avenue that has had any substantial pull with Washington. Still, their membership among individual reps needs to increase substantially to give FSI the financial leverage to fight for balance in our industry. Historically, FSI has been the voice of broker-dealers first and brokers second. Perhaps if individual representatives could have a direct roll in discussions, we’d see greater membership by individual reps.

6. Are you confident that the independent broker-dealer model will remain viable?

All levels of the independent channel will remain viable, with small firms flourishing out of their specialization, midsized firms thriving because of their high service level, and large firms attracting advisors with their depth and breadth of services. The greatest threat to the independent channel will be the rep business model that focuses primarily on advisory business going fee-only. Philosophically, rep motives for going fee-only are to “do what is in the client’s best interest” versus what is “appropriate.” On an emotional level, it’s to avoid the bureaucratic dictates of FINRA.

All levels of the independent channel will remain viable, with small firms flourishing out of their specialization, midsized firms thriving because of their high service level, and large firms attracting advisors with their depth and breadth of services. The greatest threat to the independent channel will be the rep business model that focuses primarily on advisory business going fee-only. Philosophically, rep motives for going fee-only are to “do what is in the client’s best interest” versus what is “appropriate.” On an emotional level, it’s to avoid the bureaucratic dictates of FINRA.

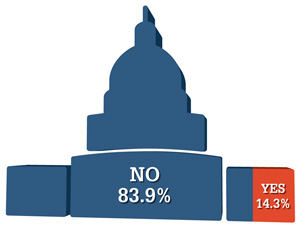

7. Do you believe that the Dodd-FrankAct will be overturned by the new Congress?

Kathryn Capagne, AIM spokesperson at the recent Jackson National Compliance Symposium, made a bold prediction that nothing will happen with the Dodd-Frank Act this year. The hard-line stance has lost momentum greatly over the last few months to the point where we may see changes to numerous components of the bill. Much of Dodd-Frank will have more of an impact on bank-owned broker-dealers than it will on non-bank firms.

Kathryn Capagne, AIM spokesperson at the recent Jackson National Compliance Symposium, made a bold prediction that nothing will happen with the Dodd-Frank Act this year. The hard-line stance has lost momentum greatly over the last few months to the point where we may see changes to numerous components of the bill. Much of Dodd-Frank will have more of an impact on bank-owned broker-dealers than it will on non-bank firms.